schedule c tax form calculator

Web The Schedule C calculator that simplifies your freelancer tax life. The business owner adds.

Tax Form 1040 Sr Senior With Magnifying Glass Generic No Year Business Concept Flat Lay Wooden Board Editorial Image Image Of Document April 174808305

Web Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income.

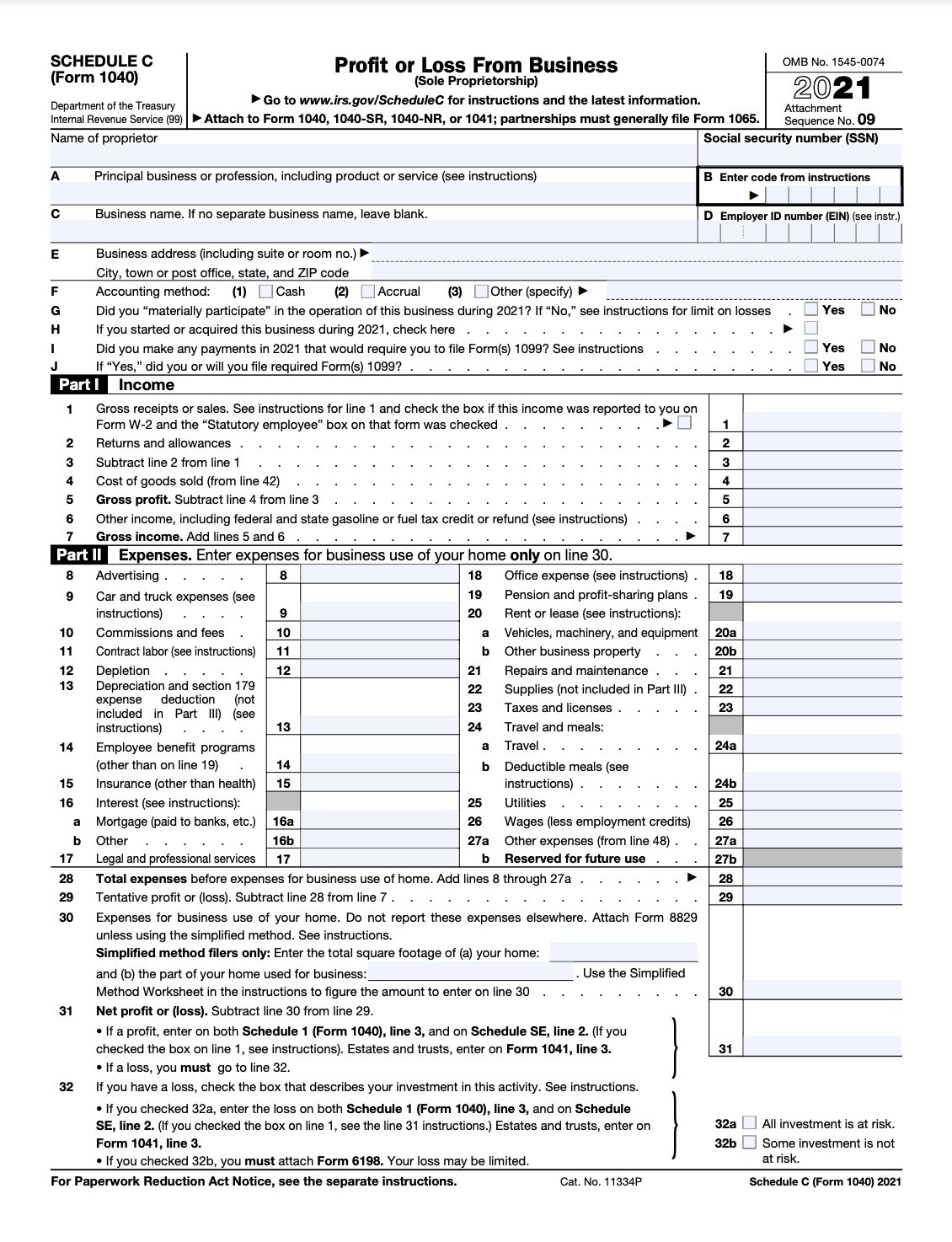

. Web Calculating Schedule C Income The formula is relatively simple you start with the net profit or less and then add-back a few items and subtract meals and entertainment. Be sure to gather the following information so that you can have it readily available. Web SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for instructions.

On Any Device OS. You will calculate the net profit or loss of a business based on the entries on Schedule C. Based on your projected withholdings for the year we can also.

If you are filing Form C-S the companys tax computation and. Web Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income. An activity qualifies as a business if your.

Web Get your Schedule C form without the hassle. Web Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Profit or Loss From Business as a stand alone tax form calculator to quickly calculate specific amounts for your 2023 tax return.

Use it to tell the government how much. Web 1040 Tax Calculator. Ad Over 50 Million.

Get your expenses organized. Web You can use the Tax Calculator to prepare your companys tax computation and work out the tax payable. Web Sole proprietors and single-owner limited liability companies LLCs use Schedule C to calculate their business net income profit or loss for the year.

Web How to fill out Schedule C. A Schedule C is a tax form filed with your personal tax return that helps you calculate the profit or loss from your business. For example Schedule C is for those who are sole proprietors or.

The rebate amount is based on an individuals. Web Use Tax Form 1040 Schedule C. Generate your 1040 Schedule C.

An activity qualifies as a business if. The results are then transferred to Form 1040 and are used. You have to fill and attach it or submit it electronically together with form 1040 when filing taxes.

Enter your filing status income deductions and credits and we will estimate your total taxes. Track and calculate your Schedule C tax deductions. Web Read over the IRS Schedule C instructions before filling out the Schedule C tax form.

Web SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for. Available in TurboTax Self-Employed and TurboTax Live. Web Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

Uncover up to 1137 in extra tax savings year. Web The Schedule C tax form is part of IRS form 1040. Our tax calculator stays up to.

Web Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Web The South Carolina Department of Revenue SCDOR has begun issuing 2022 Individual Income Tax rebates to eligible taxpayers. Web There are a few different sections of Schedule SE that apply to different kinds of self- employed individuals.

Web Enter some simple questions about your situation and TaxCaster will estimate your tax refund amount or how much you may owe to the IRS. Track your income and deductible expenses. Available in TurboTax Self-Employed and TurboTax Live.

What To Do If You Receive A Missing Tax Return Notice From The Irs

Llc Tax Calculator Definitive Small Business Tax Estimator

Llc Tax Calculator Definitive Small Business Tax Estimator

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

Irs Home Office Tax Deduction Rules Calculator

How Do Food Delivery Couriers Pay Taxes Get It Back

7 Self Employment Tax Forms For Home Business Owners

2018 Withholding New Irs Calculator Shows What You Owe Money

Tips On Using The Irs Schedule C Lovetoknow

Estimated Tax Payments For Independent Contractors A Complete Guide

How To Calculate Income From Schedule C Tax Returns 1003 Session 30 Youtube

Free 9 Sample Schedule C Forms In Pdf Ms Word

Irs Schedule C 1040 Form Pdffiller

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

New Irs Rules Mean Your Paycheck Could Be Bigger Next Year Cnn Business